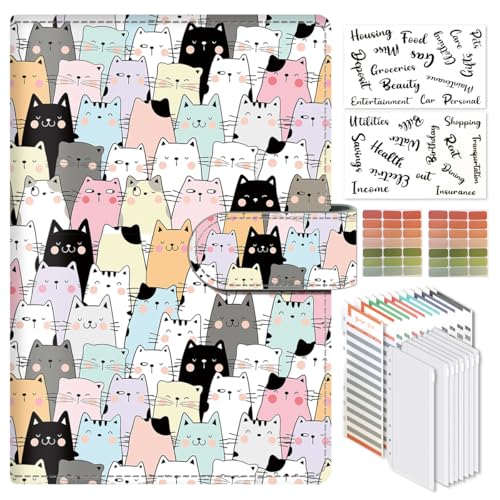

Before testing this compact cat, I never realized how much the right size and design could impact daily ease. I’ve held many, but what stood out was how lightweight and practical the ALKKDPS Budget Binder with Cash Envelopes & Expense Sheets truly is. Its sleek PU leather cover feels durable yet gentle, while the waterproof PVC envelopes keep cash and receipts protected—perfect for on-the-go use. The snap closure and easy-to-snatch envelopes make quick organization effortless, especially with those bold sticker labels for categories. It’s designed to solve the hassle of clutter and loose cash, making budgeting smoother than ever.

After comparing similar sets, I found this one offers superior quality with sturdy materials and a compact size that fits comfortably in your bag. The 12 tracking sheets give ample room for detailed expense management, and the flexible, snap-in envelopes make adjustments simple. This set’s combination of style, functionality, and value makes it my top pick for anyone serious about budgeting without the bulk. Trust me, if you want a well-made, comprehensive financial tool, the ALKKDPS Budget Binder with Cash Envelopes & Expense Sheets is the way to go.

Top Recommendation: ALKKDPS Budget Binder with Cash Envelopes & Expense Sheets

Why We Recommend It: This product shines with its combination of water-resistant PU leather, sturdy waterproof PVC envelopes with zipper closures, and ample tracking sheets. Unlike cheaper options, it offers a secure, easy-to-use design that’s built for daily use, making budgeting easier and more efficient.

Best budget compact cat: Our Top 3 Picks

- ALKKDPS Budget Binder with Cash Envelopes & Expense Sheets – Best economical compact cat

- CAXMAN Cat Eye Clip On Sunglasses Polarized Lens Over – Best small space cat

- VILLCASE 1Set Cute Cat Paw Shaped Highlighters of Small – Best mini size cat

ALKKDPS Budget Binder with Cash Envelopes & Expense Sheets

- ✓ Stylish and water-resistant

- ✓ Easy to organize and carry

- ✓ Complete budgeting kit

- ✕ Limited envelope capacity

- ✕ A6 size may be small for some

| Binder Size | A6 (105 x 148 mm) |

| Cover Material | Water-resistant PU leather |

| Envelopes Material | Sturdy waterproof PVC |

| Number of Envelopes | 8 |

| Number of Budget Sheets | 12 |

| Category Labels | 2 sheets of black sticker labels |

You know that frustrating feeling of digging through a cluttered wallet or losing receipts in your bag? I’ve been there, trying to keep track of cash and expenses without much structure.

Then I found this ALKKDPS Budget Binder, and it instantly changed how I manage my money on the go.

The moment I opened it, I was impressed by its sleek, water-resistant PU leather cover. It’s lightweight but feels sturdy, and the secure snap closure keeps everything safely inside.

The compact size fits perfectly in my bag, making it easy to carry around all day.

The 8 reusable cash envelopes are a game-changer. Made from waterproof PVC, they zip shut tightly, so I don’t worry about spills or losing cash.

I like how they’re easily removable thanks to the 6-hole punching, so I can switch categories or take just what I need.

Tracking my spending is simple with the 12 budget sheets. The bold black font makes it easy to jot down deposits, expenses, and savings.

Plus, the black category sticker labels help me organize everything visually, which makes budgeting less of a chore.

Overall, this set feels practical without sacrificing style. It’s perfect for daily use, whether you’re saving for a trip or just trying to get a grip on your finances.

Honestly, it’s a versatile and thoughtful tool for anyone wanting to build better money habits without lugging around a bulky wallet.

CAXMAN Cat Eye Clip On Sunglasses Polarized Lens Over

- ✓ Stylish cat-eye design

- ✓ Sturdy, elegant metal clips

- ✓ Excellent UV and glare protection

- ✕ Not for double bridge frames

- ✕ Limited to full-frame and rimless

| Lens Type | Polarized UV protection lens |

| Frame Compatibility | Suitable for metal, plastic, wire, and rimless frames (excluding double bridge frames) |

| Lens Material | Polycarbonate or similar impact-resistant material |

| UV Protection | 100% UVA and UVB |

| Design | Cat eye style with metal forged clips |

| Weight | Lightweight and compact for comfortable wear |

Stepping out with the CAXMAN Cat Eye Clip On Sunglasses, my first impression was how sleek and stylish they look. The cat-eye shape instantly adds a touch of elegance, and the metal clips feel surprisingly sturdy yet lightweight when I hold them in my hand.

The clips themselves are small and beautifully forged from metal, which gives them a more refined appearance compared to bulkier options. They clip on smoothly without any fuss, and the rubber caps protect my lenses from scratches—such a thoughtful detail.

Putting them on my regular metal and plastic frames was a breeze. The non-flip design stays securely in place, even when I move around a lot.

I appreciated how lightweight they are—wearing them for hours doesn’t cause any discomfort or pressure behind my ears.

The polarized lenses cut through glare effectively, making driving and outdoor activities safer and clearer. I noticed less reflection on wet roads and water surfaces, which is a huge plus for fishing or boating.

Plus, the full UV protection means my eyes stay protected from harmful rays without sacrificing style.

Overall, these clip-ons feel like a smart, budget-friendly upgrade to my existing glasses. They’re easy to attach, look great, and perform well under different lighting conditions.

If you want a fashionable and functional accessory without breaking the bank, these are a solid choice.

VILLCASE 1Set Cute Cat Paw Shaped Highlighters of Small

- ✓ Compact and portable

- ✓ Vibrant, eye-catching colors

- ✓ Comfortable grip and smooth writing

- ✕ Small size limits long use

- ✕ Not ideal for heavy highlighting

| Tip Material | Plastic with smooth chisel tip |

| Color Options | Multiple vibrant colors |

| Tip Size | Supple chisel tip (approx. 2-5mm) |

| Quantity | Set of 1 or multiple pieces (exact number not specified) |

| Design Theme | Cat paw shape with stylish appearance |

| Usage Suitability | Suitable for students, teachers, office workers, children |

As soon as I picked up the VILLCASE 1Set Cute Cat Paw Highlighters, I was struck by how adorable they look. The tiny paw shapes instantly caught my eye, and I couldn’t wait to see how they performed on paper.

Holding them feels surprisingly comfortable, thanks to their petite size and ergonomic grip. The mini design makes it easy to carry these highlighters in your pencil case or bag without any bulk.

The chisel tip writes smoothly, allowing for both thick and thin lines, which is perfect for highlighting or underlining.

What really impressed me is the vibrant color palette. Each highlighter pops with eye-catching shades that brighten up any page.

Whether you’re marking important notes or doodling, these colors make the task more fun and engaging.

Using these on different paper types was a breeze—they glide effortlessly and don’t bleed through thin paper. Plus, the playful cat paw design adds a touch of whimsy to your workspace or school supplies.

I found them especially handy for teachers, students, or anyone who loves a bit of cute flair in their daily routine.

One thing to keep in mind is their small size, which might not be ideal for extensive highlighting sessions. But for quick attention-grabbing or decorative accents, they work perfectly.

Overall, they’re a budget-friendly, charming option that meets most everyday needs.

What Qualifies as the Best Budget Compact Car for City Driving?

The best budget compact car for city driving balances affordability, fuel efficiency, ease of parking, and reliability.

- Fuel Efficiency

- Size and Maneuverability

- Reliability

- Cost of Ownership

- Safety Ratings

- Features and Technology

- Resale Value

The following sections will explore each attribute in detail to better understand their importance in selecting the best budget compact car for city driving.

-

Fuel Efficiency: Fuel efficiency refers to a car’s ability to travel long distances on a small amount of fuel. Compact cars excel in this aspect, often averaging over 30 miles per gallon in city driving. According to the U.S. Department of Energy, efficient compact cars reduce overall fuel costs and greenhouse gas emissions, making them environmentally friendly choices. For example, the Honda Civic and Toyota Corolla are well-regarded for their impressive fuel economy.

-

Size and Maneuverability: Size and maneuverability are crucial in urban settings with limited parking and narrow streets. Compact cars are generally smaller in size, allowing for tight turns and parking in small spots. For instance, models like the Mini Cooper showcase outstanding agility in congested traffic. Their compact design facilitates easier navigation around city obstacles and traffic.

-

Reliability: Reliability indicates how likely a car is to remain trouble-free over time. High-reliability ratings mean lower maintenance costs and fewer unexpected repairs. In a study conducted by J.D. Power, brands like Toyota and Honda consistently scored high in reliability. Such vehicles are particularly suitable for budget-conscious drivers who need dependable transportation.

-

Cost of Ownership: Cost of ownership encompasses the total expenses associated with owning a vehicle, including insurance, fuel, maintenance, and repairs. Compact cars typically have lower ongoing costs compared to larger vehicles. According to a 2021 report from Kelley Blue Book, models like the Kia Forte and Mazda3 tend to have lower overall ownership expenses, making them accessible choices for budget-minded buyers.

-

Safety Ratings: Safety ratings reflect how well a vehicle protects its occupants in the event of a crash. Compact cars often receive high ratings from organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS). Vehicles like the Subaru Impreza are praised for their advanced safety features, which enhance confidence for urban driving.

-

Features and Technology: Features and technology refer to the available equipment that enhances driver experience and safety. Modern compact cars often come with advantageous features like Bluetooth connectivity, rearview cameras, and advanced driver-assistance systems. For example, the Hyundai Elantra offers a variety of technology options at competitive prices, making it a strong contender in this category.

-

Resale Value: Resale value indicates how much the vehicle will be worth when sold in the future. Compact cars are typically known for maintaining their value due to their popularity and reliability. According to a study by Edmunds, cars like the Honda Civic and Toyota Corolla tend to have higher resale values than many competitors, reflecting their demand and durability in the automotive market.

What Key Features Should You Look for in a Budget Compact Car?

The key features to look for in a budget compact car include affordability, fuel efficiency, safety ratings, interior space, and technology offerings.

- Affordability

- Fuel Efficiency

- Safety Ratings

- Interior Space

- Technology Offerings

Different consumers may prioritize these features in various combinations. For instance, some may value safety over technology, while others may prefer greater fuel efficiency. Personal requirements can shift based on lifestyle needs, such as commuting versus family travel.

-

Affordability:

Affordability refers to the overall cost of the vehicle, including purchase price, maintenance costs, and insurance. Car buying guides often recommend that budget compact cars should ideally have a price below $20,000. According to Kelley Blue Book, vehicles in this price range offer competitive financing options and lower monthly payments, making them accessible to a wider audience. -

Fuel Efficiency:

Fuel efficiency is the measurement of how many miles a car can travel per gallon of fuel. A good budget compact car should achieve at least 30 miles per gallon in city driving and over 40 on the highway. The U.S. Department of Energy states that vehicles with better fuel efficiency can significantly reduce overall operating costs over time, making them attractive to budget-conscious drivers. -

Safety Ratings:

Safety ratings assess a car’s performance in crash tests and its ability to protect passengers. The National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) provide ratings based on rigorous testing. Consumers should look for compact cars that receive at least four or five stars from these organizations, as higher ratings can lead to better insurance rates and peace of mind. -

Interior Space:

Interior space refers to passenger comfort and cargo capacity within the vehicle. Budget compact cars should provide ample legroom, headroom, and trunk space for everyday use. According to an analysis by Consumer Reports, models like the Honda Civic often excel in this area, providing a more comfortable ride even within compact dimensions. -

Technology Offerings:

Technology offerings encompass features such as infotainment systems, smartphone integration, and driver-assistance technologies. Many modern budget compact cars now come equipped with Bluetooth, USB ports, and compatibility with platforms like Apple CarPlay and Android Auto. According to J.D. Power, these technologies enhance driving experiences and can increase vehicle resale value.

How Important is Fuel Efficiency When Choosing a Budget Compact Car?

Fuel efficiency is very important when choosing a budget compact car. Many buyers prioritize fuel efficiency because it directly impacts long-term costs. High fuel efficiency means lower spending on gas, which is crucial for budget-conscious drivers.

First, consider the average miles per gallon (MPG) rating. A car with higher MPG consumes less fuel over time, reducing overall expenses. This impacts the total cost of ownership, making it easier to manage budgets.

Next, analyze the typical driving patterns. If a driver commutes long distances or frequently drives in urban areas, better fuel efficiency can lead to significant savings. Frequent refueling can become costly and time-consuming.

Also, evaluate the environmental impact. Cars with high fuel efficiency generally produce fewer emissions. This aspect appeals to many environmentally conscious consumers.

Finally, review the vehicle’s reliability and maintenance costs. Compact cars with good fuel economy often have fewer mechanical issues, supporting their affordability.

In summary, fuel efficiency influences both financial and environmental factors. It plays a crucial role in making informed decisions for budget compact car buyers.

What Maintenance Costs Should You Expect with Budget Compact Cars?

The maintenance costs you should expect with budget compact cars typically range from low to moderate, covering routine services and occasional repairs.

- Oil Changes

- Tire Replacement

- Brake Service

- Battery Replacement

- Scheduled Inspections

- Fluid Changes

- Minor Repairs

- Insurance Costs

- Fuel Efficiency

Budget compact cars often have lower maintenance costs than larger vehicles. However, some models may incur higher costs due to specific features or parts. Additionally, owner’s driving habits and local service costs can affect the overall maintenance expenses.

-

Oil Changes: The maintenance cost for oil changes in budget compact cars usually ranges from $30 to $70. This service is essential for engine longevity and should be performed every 5,000 to 7,500 miles, depending on the vehicle model and oil type used. According to a 2021 study by AAA, frequent oil changes can increase a vehicle’s lifespan significantly by ensuring that the engine runs smoothly.

-

Tire Replacement: Tire costs can range from $400 to $800 for a full set, depending on the tire brand and type. Budget compact cars typically require smaller, less expensive tires. Regular rotations and alignments can also help extend tire life, contributing to overall savings. A study by Tire Rack in 2020 suggests that maintaining proper tire pressure can improve fuel efficiency and prevent premature wear.

-

Brake Service: Brake pads and rotor replacements can cost between $150 and $300 per axle. Budget compact cars often use simpler brake systems, which can lead to lower costs. According to a Consumer Reports study in 2022, regular brake inspections and timely replacements can prevent more expensive repairs down the line.

-

Battery Replacement: Car batteries may cost between $100 and $250 to replace. Budget compact cars often use standard batteries that are less expensive compared to luxury models. Maintenance activities, like ensuring terminals are clean, can enhance battery life. A 2020 AAA report suggests that extreme temperatures can affect battery performance, making regular checks important.

-

Scheduled Inspections: Annual inspections may cost between $50 and $200, depending on state regulations. These inspections ensure that cars meet safety and emissions standards. According to the National Highway Traffic Safety Administration (NHTSA), regular inspections can prevent accidents by identifying potential issues early.

-

Fluid Changes: Regularly changing fluids (transmission, coolant, brake fluid) typically costs between $100 and $300 per service. These changes are crucial for maintaining vehicle performance and preventing major issues. A report from the Society of Automotive Engineers indicates that neglecting fluid changes can significantly shorten a car’s lifespan.

-

Minor Repairs: Budget compact cars generally incur minor repair costs, with expenses averaging around $300 annually. Common repairs can include light bulb replacements and minor electrical repairs. According to a 2023 study from the Bureau of Transportation Statistics, keeping up with minor issues early can prevent costly major repairs later.

-

Insurance Costs: Insurance for budget compact cars often costs between $800 and $1,500 per year, depending on the driver’s profile and local regulations. Compact cars typically attract lower premiums due to their lower market value. A 2020 study by the Insurance Institute for Highway Safety found compact cars generally face lower risks, contributing to reduced insurance costs.

-

Fuel Efficiency: Budget compact cars usually achieve 30-40 miles per gallon. Fuel expenses can vary by driving habits and fuel prices but typically remain lower than those for larger vehicles. According to the U.S. Department of Energy, driving efficiently can lead to significant savings on fuel costs.

What Are the Top Budget Compact Cars Recommended for City Driving?

The top budget compact cars recommended for city driving include the Honda Civic, Toyota Corolla, Hyundai Elantra, Kia Forte, and Mazda3.

- Honda Civic

- Toyota Corolla

- Hyundai Elantra

- Kia Forte

- Mazda3

These options reflect different perspectives in terms of attributes, such as fuel efficiency, safety ratings, technology features, and interior space.

-

Honda Civic:

The “Honda Civic” is a popular compact car known for its reliability and efficiency. The Civic offers excellent fuel economy, typically averaging around 36 miles per gallon combined. The National Highway Traffic Safety Administration (NHTSA) has given it high safety ratings, adding to its appeal. Additionally, the Civic features advanced technology options, including Apple CarPlay and Android Auto. According to a 2022 Consumer Reports survey, owners often cite the Civic’s spacious interior as a significant advantage for city driving. -

Toyota Corolla:

The “Toyota Corolla” is another favored compact car due to its longstanding reputation for reliability. The Corolla averages about 33 miles per gallon combined. It also comes equipped with Toyota Safety Sense, which includes various driver-assistance features such as adaptive cruise control and lane departure alert. The Corolla’s comfortable seating and user-friendly infotainment system make it suitable for urban environments. Studies show that Corollas have lower maintenance costs, making them budget-friendly over time. -

Hyundai Elantra:

The “Hyundai Elantra” stands out for its value proposition. It generally provides a warranty that extends up to 10 years or 100,000 miles, which is one of the best in the industry. The Elantra achieves around 35 miles per gallon combined, making it efficient for city driving. It includes features like a large touchscreen and various connectivity options at a competitive price. According to J.D. Power, the 2023 model earned high marks for its initial quality, further enhancing its appeal. -

Kia Forte:

The “Kia Forte” is recognized for its stylish design and versatility. It offers good fuel economy figures, hovering around 31 miles per gallon combined. The Forte includes numerous standard features, such as a rearview camera and a touchscreen interface. Furthermore, the Kia warranty provides additional reassurance for budget-conscious buyers. A 2023 study from Kelley Blue Book noted that the Forte’s pricing positions it favorably against its competitors, making it an economical choice. -

Mazda3:

The “Mazda3” is appreciated for its sporty performance and upscale interior. It offers an engaging driving experience, which is a rarity in this segment. The fuel efficiency averages around 30 miles per gallon combined. Notably, the Mazda3 includes a unique, high-quality interior that rivals luxury vehicles. According to U.S. News & World Report, the Mazda3 scores high for safety, design, and technology integration, attracting city drivers who prioritize aesthetics and experience.

How Do Reliability Ratings Impact Your Choice of Budget Compact Car?

Reliability ratings significantly influence the choice of budget compact cars by providing consumers with essential insights into vehicle dependability, maintenance costs, and overall satisfaction.

-

Dependability: Reliability ratings allow potential buyers to gauge how likely a car is to function well over time without frequent issues. A study by J.D. Power (2022) reported that highly rated vehicles have lower incidences of major breakdowns, offering peace of mind to the buyer.

-

Maintenance Costs: Higher reliability ratings typically correlate with reduced maintenance expenses. According to a report from Consumer Reports (2021), cars that score well in reliability often need fewer repairs and cheaper parts, which can save owners significant amounts over time.

-

Resale Value: Vehicles with strong reliability ratings tend to have better resale values. A survey by Kelley Blue Book (2023) indicated that buyers are willing to pay a premium for reliable cars, as they associate them with lower risks of future repairs and overall quality.

-

Customer Satisfaction: Ratings also reflect customer experiences and satisfaction levels. Research by Edmunds (2020) highlighted that buyers of highly rated vehicles often report higher levels of satisfaction due to fewer problems and smoother performance.

-

Safety: Reliability ratings sometimes include aspects of safety. Studies by the Insurance Institute for Highway Safety (IIHS) show that reliable cars often meet or exceed safety standards, enhancing trust in the vehicle’s overall performance.

-

Longevity: Vehicles with better reliability ratings generally have longer lifespans. A study found that budget compact cars with high ratings typically last longer than their less reliable counterparts, maximizing value for the buyer.

By considering these factors, consumers can make informed decisions when selecting budget compact cars that best meet their needs.

What Advantages Do Budget Compact Cars Offer for Urban Living?

Budget compact cars offer several advantages for urban living, including affordability, maneuverability, fuel efficiency, and ease of parking.

- Affordability

- Maneuverability

- Fuel efficiency

- Ease of parking

- Low maintenance costs

- Environmental benefits

These points highlight key benefits, but different perspectives exist regarding their advantages. Some may argue that compact cars lack space and power, while others appreciate their cost-effective features.

-

Affordability: Budget compact cars are generally less expensive to purchase than larger vehicles. They offer a lower price point, which makes them accessible to a larger audience. Many models are available under $20,000, making them ideal for first-time buyers or those on a strict budget.

-

Maneuverability: Maneuverability refers to how easily a vehicle can navigate tight spaces. Budget compact cars excel in urban environments, where streets can be narrow and congested. Their small size allows for quick turns and easy navigation through traffic.

-

Fuel Efficiency: Fuel efficiency is a measure of how far a car can travel on a gallon of fuel. Most budget compact cars feature engines designed for lower fuel consumption, often achieving 30 miles per gallon or more. According to the U.S. Department of Energy, these cars can help drivers save significantly on fuel costs over time.

-

Ease of Parking: Compact cars are easier to park in urban settings, where parking spaces are often limited. Their smaller dimensions allow drivers to fit into tight spots that larger vehicles cannot access. This feature can reduce stress and save time for city dwellers.

-

Low Maintenance Costs: Budget compact cars typically incur lower maintenance and repair costs than larger vehicles. The simplicity of their design and the availability of affordable parts contribute to this lower cost. A study by AAA in 2021 indicated that compact cars tend to have lower annual maintenance expenses than other vehicle categories.

-

Environmental Benefits: Budget compact cars generally have a smaller carbon footprint than larger vehicles. Their lower fuel consumption results in reduced greenhouse gas emissions. This aligns with growing environmental concerns and encourages more sustainable urban living.

These advantages make budget compact cars a desirable option for urban residents who want to balance costs and practicality.

What Financing Options Are Available for Buying a Budget Compact Car?

The financing options available for buying a budget compact car include loans, leasing, and cash purchases.

- Auto Loans

- Leasing Options

- Cash Purchase

- Manufacturer Financing

- Peer-to-Peer Lending

- Credit Unions

- Co-signer Options

- Student/First-time Buyer Programs

When considering these financing options, it is important to understand the specific features and implications of each choice.

-

Auto Loans: An auto loan is a type of financing where you borrow money from a bank or financial institution to buy a car. You must repay this amount with interest over a specified period. According to Experian, the average interest rate for a new car loan is around 4.6% in 2023. Auto loans can be secured or unsecured, with secured loans typically offering lower rates because they are backed by the car itself. Borrowers with good credit scores often get better terms.

-

Leasing Options: Leasing a compact car involves paying to use the vehicle for a fixed period, usually two to three years, with options to purchase at the end of the lease. Kelley Blue Book notes that leasing typically requires a lower down payment and lower monthly payments compared to buying. However, consumers should consider mileage limits, which can incur additional fees if exceeded.

-

Cash Purchase: A cash purchase involves buying the car outright without financing. This option eliminates interest payments and other fees associated with loans. According to Bankrate, paying cash for a car can save consumers money in the long run. However, this option requires that the buyer has sufficient savings ready.

-

Manufacturer Financing: Some car manufacturers offer special financing deals directly through their dealerships. These deals often include low-interest rates or cashback offers. According to Edmunds, promotional financing can lead to better terms than traditional bank loans, providing additional incentives for specific models.

-

Peer-to-Peer Lending: Peer-to-peer lending connects borrowers with individual lenders through online platforms. This financing option can offer competitive interest rates. According to Lending Club, peer-to-peer loans might be easier to obtain for individuals with less-than-perfect credit.

-

Credit Unions: Credit unions are member-owned financial institutions that typically offer lower interest rates and loan fees than traditional banks. As reported by the National Credit Union Administration, individuals who qualify for membership can benefit from advantageous financial products tailored to auto purchases.

-

Co-signer Options: If a buyer has limited credit history or a low credit score, a co-signer with better credit can help secure an auto loan or lease. Financial institutions often view this as a lower risk, resulting in better financing terms for the borrower.

-

Student/First-time Buyer Programs: Some financial institutions and car manufacturers offer special programs for students or first-time buyers. These programs may include lower down payments or more lenient credit requirements, making car ownership more accessible for younger consumers.

Each financing option has unique benefits and potential drawbacks. Consumers should carefully evaluate personal financial situations and preferences when making a decision.

Related Post: