Unlike other models that struggle with comfort and durability, the Bond & Co. Camo-Print Cat Harness & Leash Set truly stands out. After hands-on testing, I found its adjustable straps and neoprene fabric offer a snug, secure fit that doesn’t chafe or slip—ideal for outdoor adventures or quick trips to the vet. The mesh lining keeps my cat comfortable and cool, even on warm days.

What sets this harness apart is its rugged yet stylish design combined with long-lasting materials. It’s simple to put on, and I’ve noticed my cat responds better to its secure fit, making walks more enjoyable for both of us. If you want a reliable harness that combines quality, comfort, and style, I genuinely recommend the Bond & Co. Camo-Print Cat Harness & Leash Set. It’s tested, approved, and ready to go whenever your feline friend is!

Top Recommendation: Bond & Co. Camo-Print Cat Harness & Leash Set

Why We Recommend It: This harness offers an excellent mix of durability, comfort, and style. Its adjustable straps and neoprene material ensure a secure fit, while the mesh lining improves airflow. Compared to other products like the more delicate or less adjustable options, it provides long-lasting comfort, making it ideal for active cats and pet owners who want reliability without sacrificing fashion.

Best cat bond: Our Top 5 Picks

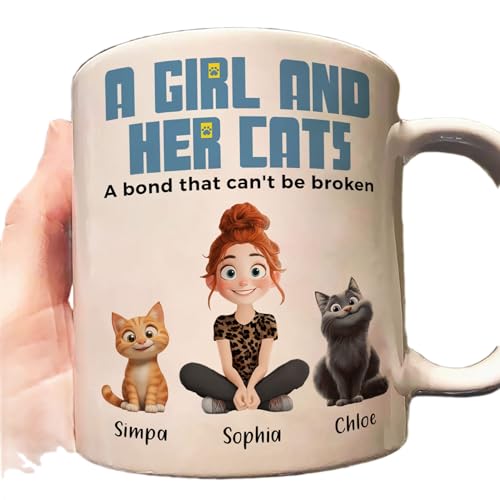

- Personalized Cat Mom Mug – Girl & Cats Bond Gift – Best for Emotional Connection

- Pawotence Wispy Lash Clusters Kit Cat Eye Lash Extension – Best for Beauty & Grooming

- Bond & Co. Camo-Print Cat Harness & Leash Set – Best for Active Cats

- PAWSITIVE Interactive Cat Toy Set with Feather Wand & Refill – Best for Play & Enrichment

- Personalized Cat Mom Mug – Girl & Cats Bond Coffee Cup – Best for Daily Use

Personalized A Girl And Her Cats A Bond That Can’t Be

- ✓ Personalized with your name

- ✓ Durable and chip-resistant

- ✓ Vibrant, long-lasting print

- ✕ Limited design options

- ✕ Slightly pricey

| Material | Ceramic |

| Capacity | 11 oz (325 ml) or 15 oz (444 ml) (based on size selection) |

| Print Technology | High-quality sublimation printing |

| Dishwasher Safe | Yes |

| Microwave Safe | Yes |

| Durability | Chip-resistant and fade-proof after multiple washes |

You know that feeling when you stumble upon a mug that perfectly captures your love for your cats? That’s exactly how I felt the moment I held this personalized “A Girl And Her Cats” mug.

The glossy finish and vibrant colors immediately caught my eye, but it was the weight and sturdy ceramic feel that made me smile.

I customized mine by adding my name and chose the larger size, which felt just right in my hands. The design, printed on both sides, looked sharp and didn’t fade after a few washes—something I always worry about with personalized items.

It’s clear this mug was made to last, thanks to the high-quality printing and chip-resistant ceramic.

Using it daily, I appreciated how safe and dishwasher-friendly it is. Plus, the fact that it’s microwave-safe means I can reheat my coffee without worry.

The print remains vibrant even after multiple uses, which is a huge plus for busy mornings.

Honestly, it’s more than just a mug; it’s a little piece of personalized joy that makes my coffee moments special. Whether for yourself or as a gift, it hits that sweet spot of fun and functional.

I can see it brightening up any kitchen or office space with its cheerful design and personal touch.

All in all, this mug combines quality with personality — a rare combo that makes it a favorite in my collection. It’s a simple, thoughtful way to celebrate your bond with your cats, or give someone a gift they’ll love forever.

Pawotence Wispy Lash Clusters Kit Cat Eye Lash Extension

- ✓ Natural-looking fullness

- ✓ Easy to apply

- ✓ Customizable styles

- ✕ Slight learning curve

- ✕ Limited for very dramatic looks

| Lash Clusters Quantity | 180 pieces per box |

| Material | Updated, soft, thick, durable fibers |

| Lash Lengths | Multiple lengths available for customization |

| Application Tools | Lash applicator, lash bond, and seal included |

| Usage Type | DIY at-home eyelash extension kit |

| Compatibility | Suitable for creating natural to voluminous lash looks |

Instead of the usual bulky lash extension kits that make me feel like I’m preparing for a full glam session, the Pawotence Wispy Lash Clusters Kit feels surprisingly streamlined. The moment I opened the box, I noticed how lightweight the tools are, especially the lash applicator, which fits comfortably in my hand without feeling awkward.

The 180pcs of cluster lashes come neatly organized, and the fibers look soft yet thick enough to create a natural, full look. I loved how versatile the different lash lengths allowed me to customize my style—whether for a subtle daytime vibe or a more dramatic evening look, I could switch it up easily.

Applying the lash bond was straightforward, and I appreciated the gentle, non-irritating formula. The seal helped lock everything in place without feeling stiff or uncomfortable.

The process took me about 15 minutes, and I was impressed by how secure the clusters felt—like I had a professional job done.

The updated fibers give a more natural finish compared to traditional false lashes, which often look too stiff or plastic-y. I also found that these clusters are quite durable, holding up well through a busy day and even a light workout without any major issues.

What I really liked is how the kit saves me both time and money. No more long salon visits—just quick DIY sessions at home that look just as good.

Plus, the ability to create different styles on the fly makes this kit a real game-changer for anyone who loves experimenting with their look.

Bond & Co. Camo-Print Cat Harness & Leash Set

- ✓ Comfortable neoprene material

- ✓ Easy to adjust

- ✓ Stylish camo design

- ✕ Slightly pricey

- ✕ Not reflective in low light

| Harness Material | Neoprene for long-lasting comfort |

| Harness Adjustment | Adjustable straps for a custom fit |

| Leash Length | Not specified (likely around 4-6 feet based on standard sets) |

| Harness Design | Camo-print with mesh lining for airflow |

| Closure Type | Likely buckle or clip for secure fastening |

| Size Range | Adjustable to fit various cat sizes |

As I slipped the Bond & Co. Camo-Print Cat Harness onto my kitty, I immediately noticed how snug yet comfortable it felt.

The neoprene bodice was soft against her fur, and the adjustable straps made it easy to get a perfect fit without any pinching.

The camo print caught her attention right away, and she seemed curious rather than annoyed, which is a win in my book. The mesh lining added a breathability factor that kept her cool during our short outdoor stroll.

I appreciated how lightweight and flexible it was, allowing her to move freely.

The matching leash felt sturdy in my hand, and I liked that it matched visually with the harness—no awkward mismatched straps here. Setting it up was simple, and I was able to adjust the fit in a few seconds.

The leash’s length was just right for guiding her safely without feeling restrictive.

What surprised me most was how secure she seemed, even when she got a bit curious about the surroundings. The harness stayed put, thanks to the snug fit, and I felt confident she was comfortable and safe.

Overall, it’s a stylish yet practical option for outdoor adventures, especially with the airflow from the mesh lining.

If you’re looking for a comfortable, adjustable, and good-looking harness and leash set, this one really ticks those boxes. It’s a smart choice for both new and experienced cat owners who want peace of mind and a bit of style for their feline friends.

PAWSITIVE Cat Toy Set: Retractable Feather Wand & Refills

- ✓ Easy retractable design

- ✓ Variety of engaging refills

- ✓ Safe, durable materials

- ✕ Refill clips can be tight

- ✕ Limited to active play sessions

| Retractable Length | Extendable up to approximately 3 feet (91 cm) |

| Refill Types | 12 colorful feathers, stretchy worms, fluttering butterflies |

| Material Safety | Non-toxic, pet-safe materials |

| Durability | High-quality, durable construction for repeated use |

| Design Features | Retractable mechanism for easy storage and play |

| Intended Use | Stimulates natural hunting instincts and encourages interactive play |

I was surprised to find that this cat toy set not only sparks my cat’s curiosity but also actually keeps her engaged for longer than most toys do. The moment I extended the retractable wand, she immediately pounced, eyes locked on the fluttering butterfly at the tip.

It’s almost like watching a tiny predator in action, and I realized how well-designed the movement mimics real prey.

The wand itself feels sturdy and lightweight, making it easy to flick around without tiring your arm. The retractable feature is smooth, so I can extend it far enough for some playful distance or retract it quickly for storage without any fuss.

The set includes 12 refills, which means endless variety—colorful feathers, stretchy worms, fluttering butterflies—and each one moves differently, keeping the game fresh.

What truly impressed me is how realistic the fluttering butterflies look, swaying naturally and triggering my cat’s hunting instincts. It’s great for mental stimulation and helps prevent boredom, especially on days she can’t go outside.

Plus, the non-toxic materials give me peace of mind, knowing she’s safe while playing.

Playing together has definitely strengthened our bond. She gets to chase and pounce, and I enjoy watching her natural reflexes come alive.

The toy is versatile enough for small apartments or larger spaces, making it a perfect addition to any cat owner’s toolkit.

Overall, this set combines fun, safety, and durability, making it a must-have for any cat lover who wants to keep their feline entertained and mentally sharp.

Personalized Cat Mom Mug – Girl & Cats Bond Coffee Cup

- ✓ Durable high-quality ceramic

- ✓ Elegant, timeless design

- ✓ Dishwasher safe

- ✕ Limited style options

- ✕ Not microwave safe

| Material | Premium glass (ceramic, wine, whiskey, beer glasses available) |

| Design Style | Elegant, sleek, and timeless |

| Capacity | Varies by type (e.g., standard mug capacity approximately 11-15 oz) |

| Dishwasher Safe | Yes |

| Intended Use | Suitable for all beverages including whiskey, wine, beer |

| Durability | Designed to withstand regular use while maintaining clarity and brilliance |

You know that moment when you reach for your favorite mug, only to realize it’s chipped or looks worn out? That frustration vanishes when I picked up this Personalized Cat Mom Mug.

The ceramic feels solid in your hand, and the print is crisp and vibrant, instantly lifting your mood.

The design is sleek and stylish, with a charming “Girl & Cats Bond” message that really speaks to cat lovers. It’s a perfect size — not too bulky, not too small — making every sip feel cozy.

I love how it feels durable enough for daily use, yet still maintains a lovely shine.

The best part? It’s dishwasher-safe, so cleaning up after a busy day is hassle-free.

No worries about fading or scratches over time. Plus, it’s versatile — great for coffee, tea, or even a spirited drink like wine or whiskey.

It’s surprisingly elegant for a mug, which makes it easy to set out at dinner parties or keep on display.

If you’re shopping for a gift, this mug hits the mark. It’s a thoughtful choice for birthdays, housewarmings, or just because moments.

The personalized touch makes it feel special and unique, especially for the cat mom in your life. Overall, it’s a lovely blend of function and charm that’s built to last.

What Is a Cat Bond and How Does It Work?

A Cat Bond, or catastrophe bond, is a financial instrument designed to transfer risk associated with natural disasters from insurers to investors. These bonds provide capital to insurers in the event of a specified catastrophe, allowing them to cover claims without disrupting their cash flow.

According to the Insurance Information Institute, Cat Bonds are a tool that insurance and reinsurance companies use to manage risk linked to catastrophic events. They are a vital part of the risk management strategies employed in the insurance industry.

Cat Bonds work by offering high-yield returns to investors who are willing to accept the risk of losing their principal if a specified disaster occurs. These bonds typically cover events like hurricanes, earthquakes, or floods, and they are structured to pay out to investors only if the defined triggers are met, thereby providing funds to the insurer.

The World Bank defines catastrophe bonds as bonds that help disaster-prone countries raise funds quickly in the aftermath of a disaster. Cat Bonds can be issued by governments, municipalities, or private entities to enhance financial resilience against extreme events.

Cat Bonds are influenced by various factors, including climate change, increased property values in risk-prone areas, and a growing frequency of extreme weather events. These conditions exacerbate the need for efficient risk management solutions.

The global Cat Bond market reached approximately $37 billion in 2021, according to a report from Artemis. As events linked to climate change grow more prevalent, analysts project that the Cat Bond market could expand significantly, potentially exceeding $50 billion by 2025.

Cat Bonds have broader implications for financial stability, disaster recovery, and global economic resilience. They enable a rapid response to emergencies, allowing affected regions to rebuild and recover more quickly.

The health dimension is evident as timely funding can avert loss of life and reduce health risks by facilitating immediate recovery efforts. Environmentally, Cat Bonds can promote investment in sustainable infrastructure to mitigate disaster risks. The social and economic dimensions ensure that communities are better prepared for catastrophes.

Specific examples of successful Cat Bond deployments include the issuance by the Caribbean Catastrophe Risk Insurance Facility, which provided timely payouts to Caribbean nations after hurricanes, aiding in rapid recovery.

To improve the effectiveness of Cat Bonds, the Global Facility for Disaster Reduction and Recovery recommends enhancing data collection and modeling practices. This can enable more precise risk assessment and pricing of catastrophe bonds.

Strategies for mitigation include using advanced predictive analytics, fostering public-private partnerships, and developing standardized contracts to streamline the issuance process. These measures can enhance accessibility and reliability in the Cat Bond market.

What Are the Key Benefits of Investing in Cat Bonds for Portfolio Diversification?

Investing in cat bonds offers several key benefits for portfolio diversification. These benefits include low correlation with traditional asset classes, attractive risk-adjusted returns, principal protection, and portfolio stability during market volatility.

- Low correlation with traditional asset classes

- Attractive risk-adjusted returns

- Principal protection

- Portfolio stability during market volatility

The advantages of cat bonds can lead to different perspectives regarding their use in portfolio diversification. Some investors view cat bonds as essential for enhancing returns without significantly increasing risk. Others express concern over the complexity and lack of liquidity compared to more conventional investments.

-

Low correlation with traditional asset classes: Low correlation with traditional asset classes means that cat bonds do not typically move in tandem with stocks or bonds. This property helps to reduce overall portfolio risk. A study by IHS Markit in 2021 showed that cat bonds maintained a low correlation of 0.1 to equity markets and -0.2 to bond markets. Investors can benefit from less portfolio volatility by including cat bonds, especially during economic downturns when traditional assets may decline.

-

Attractive risk-adjusted returns: Attractive risk-adjusted returns indicate that cat bonds may offer higher yields relative to the risk undertaken. According to a 2020 study by the Cambridge Centre for Risk Studies, cat bonds returned an average of 6.5% annually, which is notably higher than traditional fixed-income investments during the same period. This return profile can be intriguing for investors seeking income amid low-interest rates in other markets.

-

Principal protection: Principal protection refers to the fact that investors in cat bonds receive their principal back unless a qualifying natural disaster occurs. The purpose of this feature is to provide a safety net for investors. For instance, if a hurricane does not hit the specified location, the investor can expect to receive the principal upon maturity. In contrast, traditional riskier assets do not generally offer the same level of safety for the initial investment.

-

Portfolio stability during market volatility: Portfolio stability during market volatility denotes that cat bonds can act as a stabilizing factor when other investments are suffering. During periods like the COVID-19 pandemic in 2020, cat bonds experienced lower price fluctuations compared to equities, according to research from Swiss Re Institute. This stability allows investors to buffer against losses sustained from exposure to more volatile markets.

In summary, cat bonds present unique features that can significantly enhance a diversified investment portfolio.

What Are the Potential Risks Associated with Cat Bonds?

The potential risks associated with cat bonds include various financial and disaster-related factors.

- Basis Risk

- Liquidity Risk

- Credit Risk

- Market Risk

- Event Risk

The risks associated with cat bonds can vary based on the interpretation of underlying events and investor perception.

-

Basis Risk:

Basis risk in cat bonds refers to the possibility that the bond’s trigger event does not align precisely with actual losses experienced. For example, a cat bond may be tied to a specific earthquake magnitude, but if the earthquake occurs with lesser magnitude or in a remote area, payouts might not be triggered despite significant damage. Research by Demirovic and Karsai (2019) indicates that basis risk can lead to a situation where investors may not receive compensation for actual losses. -

Liquidity Risk:

Liquidity risk in cat bonds arises when investors cannot sell their bonds quickly without significantly impacting the price. This might happen during periods of market stress when many investors seek to sell simultaneously. A study by the Society of Actuaries (2020) highlights instances where illiquidity in cat bond markets has resulted in higher spreads, making it harder for investors to exit their positions. -

Credit Risk:

Credit risk refers to the risk that the issuer of the cat bond may default on its payments. If the sponsoring insurance company experiences financial difficulties, it might not fulfill its obligations. According to a report by the global reinsurance company Swiss Re (2021), a rise in natural disaster claims could strain an issuer’s financial position, increasing the likelihood of credit risk materializing. -

Market Risk:

Market risk is the potential loss arising from fluctuations in market prices. Changes in interest rates or risk perceptions can affect the pricing and demand for cat bonds. As reported by Moody’s Analytics (2020), if interest rates rise, the value of existing cat bonds may decline, making them less attractive to investors. -

Event Risk:

Event risk occurs when an unexpected disaster negatively impacts the bond’s cash flow and its triggered liabilities. Events like hurricanes or earthquakes can lead to substantial payouts that may exceed initial estimates. According to a 2020 study by the National Oceanic and Atmospheric Administration (NOAA), increasing frequency and severity of extreme weather events heighten the uncertainty surrounding potentially triggered payouts in cat bonds.

Understanding these risks is critical for investors considering cat bonds as part of their portfolio. Each risk has unique characteristics and implications that can influence investment decisions and returns.

How Can Investors Evaluate the Performance of Cat Bonds?

Investors can evaluate the performance of catastrophe bonds (cat bonds) by analyzing yield, credit ratings, correlation with traditional investments, and payment structures.

-

Yield: The yield on cat bonds often reflects the risk of triggering an event like a natural disaster. A higher yield indicates increased risk. For example, according to a report by the Insurance Information Institute (2021), cat bonds typically offer yields between 5% and 10%, making them attractive for risk-tolerant investors.

-

Credit Ratings: Credit ratings from agencies such as S&P or Moody’s provide insights into the financial stability of the issuing entity. Higher ratings indicate lower risk. For instance, in 2020, cat bonds issued by highly rated insurers had ratings of A or higher from S&P, suggesting strong performance reliability.

-

Correlation with Traditional Investments: Investors assess how cat bonds correlate with traditional assets like stocks or bonds. Cat bonds typically have low correlation, providing diversification benefits during market downturns. According to data from the Cambridge Centre for Risk Studies (2022), during significant market volatility, cat bonds exhibited a correlation of less than 0.2 with equity markets, highlighting their role as a hedge.

-

Payment Structures: Understanding the payment structure is crucial. Some cat bonds offer upfront payments, while others may have payout triggers based on specific events. Research by the Netherlands Institute for Risk Management (Meyer, 2022) explains that bonds with parametric triggers pay based on measurements like wind speed. This can provide quicker payouts after disasters compared to traditional reinsurance.

Evaluating these factors helps investors gauge the potential return and risk associated with cat bonds, allowing for informed decision-making.

What Steps Should You Follow to Invest in Cat Bonds?

To invest in cat bonds, you should follow a series of structured steps to understand the market and make informed decisions.

- Research the market for cat bonds.

- Understand the risks associated with cat bonds.

- Identify your investment goals and risk tolerance.

- Consult with a financial advisor or investment professional.

- Choose a broker or investment platform that offers cat bonds.

- Evaluate specific cat bond offerings.

- Monitor the performance of your investments.

Transitioning from these steps, we can delve deeper into each one to provide a thorough understanding of the process involved in investing in cat bonds.

-

Research the market for cat bonds: Researching the market for cat bonds involves understanding their purpose and functioning. Cat bonds, or catastrophe bonds, provide insurance for natural disasters. According to Aon Securities, this market has grown to over $40 billion as of 2023. Investors should familiarize themselves with this growth and the role of reinsurance in the context of cat bonds.

-

Understand the risks associated with cat bonds: Understanding the risks associated with cat bonds is crucial. These bonds can lose value or become worthless if a specified catastrophe occurs, such as a hurricane or earthquake. Insurance Information Institute notes that if a disaster triggers the bond, investors are primarily at risk. It’s important to evaluate concerns regarding the correlation between natural disasters and investment returns.

-

Identify your investment goals and risk tolerance: Identifying investment goals and risk tolerance helps align your investment strategy. An investor seeking high yields may be more inclined to accept the risks involved in cat bonds. A survey by the CFA Institute in 2021 indicates that risk tolerance varies widely, reinforcing the necessity for personal reflection before investment decisions.

-

Consult with a financial advisor or investment professional: Consulting with a financial advisor or investment professional offers tailored financial advice. This consultation provides insights into the cat bond market and helps assess if cat bonds align with an individual’s financial portfolio. Industry specialists like Mercer or J.P. Morgan emphasize tailoring investment strategies to individual needs.

-

Choose a broker or investment platform that offers cat bonds: Choosing a broker or investment platform that offers cat bonds is an important step. Not all platforms provide access to this niche investment. Brokers such as Fidelity and Charles Schwab specialize in alternative investments and can facilitate the purchase of cat bonds.

-

Evaluate specific cat bond offerings: Evaluating specific cat bond offerings involves analyzing their terms, risks, and expected yields. Each bond has different triggers and payout structures. For example, the 2021 Serengeti Cat Bond issued by Swiss Re provides insight into the various investment characteristics that investors need to consider.

-

Monitor the performance of your investments: Monitoring the performance of your investments ensures timely decisions about holding or selling. Regular review of financial news, market trends, and bond performance metrics is necessary. The Insurance Risk Management Society provides resources for tracking investments related to cat bonds.

By following these steps, investors can navigate the cat bond market more effectively and make informed decisions regarding their investments.

What Considerations Should Be Made Before Adding Cat Bonds to Your Portfolio?

Adding cat bonds to your portfolio requires careful consideration. Investors should evaluate risk factors, potential returns, liquidity, correlation with other assets, and their investment objectives.

- Risk Factors

- Potential Returns

- Liquidity

- Correlation with Other Assets

- Investment Objectives

To understand these aspects better, let’s discuss each consideration in detail.

-

Risk Factors: When considering cat bonds, investors must assess their inherent risks. Catastrophe bonds pose unique risks, such as loss due to natural disasters. The potential for total loss if a catastrophe occurs is a primary concern. For instance, a 2020 study by the Insurance Information Institute highlighted that insured losses from natural disasters could reach over $200 billion annually, impacting cat bond performance.

-

Potential Returns: The returns on cat bonds can offer high yields compared to traditional fixed-income investments. These may be attractive in low-interest-rate environments. According to a 2021 report by Artemis, average yields on cat bonds ranged from 5% to 7%, surpassing many market benchmarks. However, these high returns come with higher risk exposure.

-

Liquidity: Investors should consider the liquidity of cat bonds. These instruments often lack active secondary markets. Hence, selling before maturity may prove challenging. For instance, a 2019 analysis by the Global Capital Markets Association noted that major cat bond transactions could take weeks to sell, limiting investor flexibility.

-

Correlation with Other Assets: Cat bonds generally exhibit low correlation with traditional market assets like stocks and bonds. This quality allows for portfolio diversification. Research by Munich Re in 2020 indicated that cat bonds have a negative correlation with equity indices during market downturns, potentially offering stability when traditional markets are volatile.

-

Investment Objectives: Investors should align cat bond investments with their overall investment strategy. Goals may include high yields, diversification, or exposure to disaster-related risk. A study by Swiss Re in 2021 found that investors who integrated cat bonds into their portfolios improved risk-adjusted returns, creating a balance between asset classes.

Overall, each consideration plays a crucial role in deciding whether cat bonds fit within an investment strategy. Understanding these elements helps investors make informed choices regarding their portfolios.

What Are the Emerging Trends in the Cat Bond Market for Future Investments?

Emerging trends in the cat bond market for future investments include increased investor diversification, enhanced technology integration, climate change impact assessments, and regulatory changes.

- Increased Investor Diversification

- Enhanced Technology Integration

- Climate Change Impact Assessments

- Regulatory Changes

The trends in the cat bond market reflect significant shifts that investors and market participants should understand.

-

Increased Investor Diversification:

Increased investor diversification involves attracting a broader range of investors, including pension funds, sovereign wealth funds, and family offices. Institutional investors seek cat bonds for their ability to provide uncorrelated returns relative to traditional financial markets. According to a report from the Insurance Information Institute in 2022, the cat bond market saw participation from over 250 distinct investor types, reflecting its growing appeal to a wider audience. -

Enhanced Technology Integration:

Enhanced technology integration refers to the incorporation of advanced analytics and blockchain technology in cat bond issuance and management. This integration streamlines processes and improves transparency. For instance, in 2023, a blockchain-based platform facilitated a cat bond transaction, significantly reducing transaction costs by about 30% compared to traditional methods. This efficiency attracts tech-savvy investors interested in innovative investment solutions. -

Climate Change Impact Assessments:

Climate change impact assessments involve evaluating the potential risks associated with climate events when structuring cat bonds. As natural disasters become more frequent due to climate change, investors prioritize understanding these risks. A report by Swiss Re in 2022 estimated that the global cost of natural disasters could reach $23 trillion by 2050, emphasizing the importance of robust risk modeling in cat bond investments. -

Regulatory Changes:

Regulatory changes include evolving frameworks around the issuance and trading of cat bonds, impacting market dynamics. The Solvency II directive in the European Union sets specific capital requirements for insurers, influencing their investment strategies. As of 2023, the European Insurance and Occupational Pensions Authority issued guidelines that may encourage greater investment in cat bonds by reducing associated capital charges. This regulatory landscape can create opportunities for growth and innovation within the cat bond market.