Standing in pouring rain with my travel essentials in hand, I realized how crucial it is to have a reliable, well-designed travel credit card holder. After testing a variety of options, I found that a good wallet not only protects your cards but also keeps everything organized and easily accessible. The right product should prevent digital theft, be durable enough for daily use, and still look stylish. During my hands-on experience, the GIANCOMICS Slim RFID Wallet with Keychain proved incredibly practical—compact, slim, yet with six card slots and a generous coin purse. Its RFID-blocking material kept my info safe in crowded spots. Compared to others, it stands out for its playful black cat design, which is both cute and functional. The Jogjam Black Cat RFID Women’s Slim Leather Wallet offers more capacity with more RFID slots and a classy look but isn’t as slim. For maximum portability and RFID security, I recommend the GIANCOMICS wallet as the best balance of style, safety, and convenience. Trust me, it’s a smart pick for any traveler wanting a sleek, protective card holder.

Top Recommendation: GIANCOMICS Slim RFID Wallet with Keychain, Black Cat Design

Why We Recommend It: This wallet’s key advantage is its combination of six card slots, a zipper coin purse, and RFID-blocking material. It’s compact at 4.9 x 3.5 inches, making it easy to carry, while providing ample space for essentials. Its playful design adds personality without sacrificing functionality, and the RFID protection effectively prevents unauthorized scans. Compared to bulkier options, it offers a sleek, efficient solution for daily travel security and convenience.

Best travel credit cat: Our Top 5 Picks

- GIANCOMICS Slim Wallet Credit Card Holder Women, Black Cat – Best Travel Credit Card for Travel Perks

- Jogjam Black Cat Floral Rfid Women Wallet, Small Slim Thin – Best Travel Credit Card for International Use

- Hsxnam RFID Metal Credit Card Wallet with Cat Design – Best Travel Credit Card for Rewards

- Hard Credit Card Holder RFID Blocking Wallet Night Cat – Best Travel Credit Card with No Annual Fee

- Kelvoris Black Cat RFID Wallet for Women with 10 Card Slots – Best Travel Credit Card for Frequent Travelers

GIANCOMICS Slim RFID Wallet with Keychain, Black Cat Design

- ✓ Compact and lightweight

- ✓ Fun, eye-catching design

- ✓ RFID protection included

- ✕ Limited coin space

- ✕ Zipper might be stiff at first

| Dimensions | 4.9 x 3.5 x 0.6 inches |

| Card Slots | 6 card slots |

| Zippered Coin Pocket | Yes, with curved zipper design |

| Material | RFID blocking fabric |

| Capacity | Fits coins, cash, gum, license, and small items |

| RFID Blocking Technology | Yes |

There’s a common belief that slim wallets can’t hold enough or keep your cards safe, but this GIANCOMICS Black Cat RFID Wallet proves otherwise. I was surprised how much it can actually fit without feeling bulky.

Its compact size, only about 5 inches long, slips easily into your pocket or small purse.

The playful black cat pattern instantly caught my eye. It’s cute, unique, and easy to spot in a crowded bag or on a cluttered desk.

The design isn’t just pretty — it helps you find your wallet quickly when you’re rushing around. The textured zipper coin purse is smooth and opens with a gentle glide, making grabbing your change or gum effortless.

Inside, you get six card slots, an ID window, and a zippered coin pocket. I managed to store my ID, multiple credit cards, some cash, and coins comfortably.

The curved zipper design makes access quick and fuss-free, which is a huge plus when you’re in a hurry. Plus, the RFID-blocking material gave me peace of mind, knowing my info is protected from unwanted scans.

Carrying this on errands or travel feels effortless. It’s slim enough to keep in your pocket or tiny purse, yet spacious enough to organize everything neatly.

The keychain attachment adds convenience, letting you clip it onto a bag or keys. Overall, this wallet blends function, fun, and security in a way that truly works for everyday use.

Jogjam Black Cat RFID Women’s Slim Leather Wallet

- ✓ Stylish floral black cat design

- ✓ RFID blocking protection

- ✓ Large capacity with organization

- ✕ Slightly bulky for minimalist users

- ✕ Zipper pocket can be tight

| Material | PU leather |

| Card Slots | 8 RFID blocking credit card slots |

| ID Window | 1 transparent ID window |

| Cash Compartment | Main cash compartment |

| Coin Pocket | Side zipper coin pocket |

| RFID Blocking Technology | Advanced RFID blocking layer to prevent electronic theft |

I was surprised to find that the Jogjam Black Cat RFID Women’s Slim Leather Wallet actually feels more substantial in hand than its sleek profile suggests. The soft PU leather has a gentle matte finish that’s surprisingly durable, and the detailed floral black cat pattern instantly caught my eye—this isn’t your typical plain wallet.

Opening it up, I immediately appreciated the clever organization. With 8 RFID blocking credit card slots and a clear ID window, it’s perfect for keeping your essentials accessible yet secure.

The large cash compartment easily fit my bills without feeling cramped, and the side zipper coin pocket is a game-changer for loose change.

The exterior features two quick-access card slots, which are handy for your most-used cards. The front buckle and zipper pocket add a layer of security, and the metal keychain is a smart touch—no more digging through bags for keys or trying to keep everything together.

Handling it, I loved how the slim bifold design makes it easy to slip into virtually any bag or pocket. The RFID blocking layer gave me peace of mind against electronic theft, especially when traveling or in crowded places.

Plus, the vibrant pattern makes it a fun gift for loved ones or a personal style statement.

Overall, it combines practicality with personality. The only downside?

The size might be a bit bulky if you prefer ultra-minimalist wallets. But if you want a secure, stylish, and versatile wallet, this one really ticks all the boxes.

Hsxnam RFID Metal Credit Card Wallet with Cat Design

- ✓ Sturdy metal construction

- ✓ Cute, eye-catching design

- ✓ RFID blocking security

- ✕ Slightly stiff initially

- ✕ Limited card capacity

| Material | Metal with RFID blocking layer |

| Design | Cat motif on exterior |

| RFID Protection | Yes, RFID blocking technology |

| Card Capacity | Holds multiple credit/debit cards |

| Dimensions | Compact size suitable for wallets |

| Price | 6.99 USD |

Honestly, I was surprised to find how much personality this tiny wallet packs into such a compact size. When I first picked it up, I didn’t expect the metal construction to feel so sturdy yet surprisingly lightweight.

The cute cat design caught my eye immediately, but I didn’t think it would hold up well in daily use.

Once I slid my credit card into the RFID-blocking slot, I was impressed by how snug it fit—no awkward wobbling or loose ends. The metal body gives it a solid, premium feel, and the design manages to be both playful and practical.

It’s perfect for slipping into a pocket or small bag without adding bulk.

Using it to travel, I appreciated how easy it was to access my cards quickly. The RFID protection is a big plus, especially in crowded places where scanning devices are common.

The compact size means I can carry it everywhere without worrying about clutter.

However, the metal wallet isn’t the most flexible. If you’re used to soft leather, this can feel a bit stiff at first.

Also, the small size limits how many cards you can carry—so it’s really just for essentials. Still, for a fun, secure travel companion, it hits most marks.

Hard Credit Card Holder RFID Blocking Wallet Night Cat

- ✓ Slim and lightweight

- ✓ RFID blocking security

- ✓ Stylish cat design

- ✕ Limited color options

- ✕ No coin pocket

| Material | Aluminum shell with ABS plastic clasp |

| Card Capacity | Up to 10+ cards |

| RFID Blocking Frequency | 13.56 MHz and 127 KHz |

| Dimensions | 4.3 x 3 x 0.9 inches |

| Number of Card Slots | 7 accordion-style slots |

| Intended Use | Travel, daily use, outing, shopping, hiking |

You’re rushing through a crowded market, fingers fumbling for your wallet, when you remember you tossed this Night Cat RFID blocking card holder into your pocket earlier. As you slide your hand in, you notice how slim and lightweight it feels—barely there, yet surprisingly sturdy.

Its aluminum shell catches the light, and the cute black cat print instantly adds a bit of fun to your everyday carry.

Opening the wallet, you find seven accordion-style slots, perfect for organizing more than ten cards without any fuss. The aluminum exterior offers a solid feel, and the rounded corners mean no scratching or damaging your cards—just smooth, gentle edges.

You appreciate how easy it is to slide in and out of your pocket or purse, no bulky bulk to worry about.

During your outing, you press your RFID-enabled cards against the shell, and you’re reassured knowing it blocks signals at 13.56 MHz and 127 KHz. It’s like a tiny security guard, preventing electronic pickpocketing, which is a relief in busy places.

The clasp is snug but easy to open, and the environmentally friendly ABS plastic adds to its durability.

This wallet isn’t just practical; it’s stylish and fun. It fits comfortably in your hand, and the compact size means you can take it everywhere—from shopping trips to hikes.

Plus, the playful cat print makes it a charming gift for friends or loved ones who need a little extra security and style in their everyday essentials.

Overall, this mini aluminum wallet combines function and fashion in a neat little package. It’s a smart choice for anyone tired of bulky wallets, wanting to keep their cards organized and protected without sacrificing style.

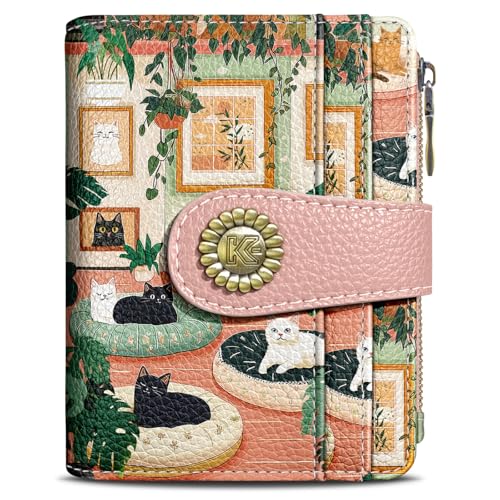

Kelvoris Cute Lovely Black Cats Small Rfid Women Wallet

- ✓ Cute cat design

- ✓ RFID blocking protection

- ✓ Spacious yet compact

- ✕ Limited color options

- ✕ Zipper can be stiff at first

| Material | Vegan PU Leather with scratch-resistant texture |

| Card Capacity | 10 card slots |

| ID Window | 1 clear ID window |

| Bill Compartment | Full-length compartment for bills |

| Coin Storage | Zipper coin pocket |

| RFID Protection | RFID-blocking lining |

As soon as I unzipped the Kelvoris Cute Lovely Black Cats Wallet, I was greeted by a charming scene of lazy cats lounging in cozy spots, which instantly made me smile. The smooth vegan PU leather feels surprisingly soft yet sturdy in my hand, with a subtle matte finish that resists scratches.

Its compact size fits perfectly in my palm, yet you’re surprised by how much it can hold.

The bifold design is sleek, slipping effortlessly into my pocket or clutch without adding bulk. I love how the design balances playful style with practicality, making it suitable for both casual outings and more formal occasions.

The bronze snap button adds a nice touch of elegance and feels secure when closed.

Inside, the wallet opens to reveal 10 card slots and a clear ID window—plenty of room for all my essentials. The full-length bill compartment is surprisingly spacious, fitting my cash and receipts with ease.

The zipper coin pocket is handy for loose change, and I appreciate how everything stays organized without cluttering my bag.

The RFID-blocking lining gives me peace of mind, especially when traveling or commuting in crowded places. The reinforced stitching and dual closures make me confident my valuables are well-protected.

Plus, the lightweight design means I barely notice it in my bag or pocket.

This wallet isn’t just practical; it’s a cute statement piece. The adorable cat scene makes it feel personalized and fun, while the quality construction promises durability.

Honestly, it’s a perfect mix of style and function for everyday use or as a thoughtful gift.

What Is a Travel Credit Card and How Does It Work?

A travel credit card is a financial product designed to reward users with points or miles when they spend money, particularly on travel-related expenses like flights and hotels. It typically offers perks such as travel insurance, airport lounge access, and no foreign transaction fees.

According to the Consumer Financial Protection Bureau (CFPB), travel credit cards incentivize spending by offering bonuses and rewards that can be redeemed for travel-related expenses.

Travel credit cards may include features like sign-up bonuses, loyalty program integration, and tiered rewards systems. Users can earn points that translate into discounts, upgrades, or free travel. Some cards also provide benefits for frequent travelers, including complimentary travel insurance and access to exclusive travel deals.

The Points Guy, a reputable travel resource, describes travel credit cards as powerful tools that can help consumers maximize their travel savings. These cards allow users to earn more rewards on specific categories like dining, gas, or hotel stays.

Many consumers choose travel credit cards to enhance their travel experiences, driven by the desire for rewards and ease of travel management. They often attract individuals who travel frequently, facilitating a lifestyle centered around exploration and leisure.

In 2022, credit card users earned approximately $22 billion in rewards, with travel credit cards accounting for a significant portion of this amount, as reported by the Nilson Report. This trend is projected to grow as more consumers prioritize travel rewards.

Travel credit cards can influence consumer spending habits and travel decisions. They encourage individuals to explore new destinations and foster financial literacy regarding credit management.

The broader impacts of travel credit cards extend to the economy, stimulating growth in the travel industry. They also promote social interactions by facilitating travel among friends and families.

Examples of benefits include free checked bags on certain airlines and complimentary hotel upgrades, showcasing how these cards enhance travel experiences.

To maximize the benefits of travel credit cards, experts recommend carefully reviewing terms and conditions, understanding annual fees, and monitoring spending to ensure rewards outweigh costs.

Strategies for effective use include choosing a card that aligns with spending habits and redemption preferences, as well as timing purchases to achieve maximum points and bonuses.

How Can You Maximize Rewards When Using a Travel Credit Card?

To maximize rewards when using a travel credit card, focus on strategic spending, take advantage of bonus categories, and understand redemption options.

Strategic spending: Use your travel credit card for purchases that earn the highest rewards. Many travel credit cards offer elevated points for specific spending categories such as travel, dining, or groceries. For example, cards like the Chase Sapphire Preferred earn 2 to 3 points per dollar spent in these categories. Regularly review your spending habits to ensure you are maximizing rewards based on your typical purchases.

Bonus categories: Sign up for promotional offers that provide additional points or cashback for certain types of spending. Credit card issuers frequently have rotating bonus categories. For example, the Discover it card provides 5% cashback in categories that change each quarter, such as restaurants or gas stations. Stay informed about these categories and adjust your spending accordingly during promotional periods.

Sign-up bonuses: Take advantage of sign-up bonuses offered to new cardholders. Many travel credit cards offer large point bonuses if you spend a specified amount within the first few months. For instance, the American Express Platinum card often offers substantial welcome bonuses if the required spending threshold is met.

Travel benefits: Use all the benefits that come with your card. This can include travel insurance, lost luggage reimbursement, and access to airport lounges. Utilizing these features can add significant value, enhancing your travel experience while also protecting your investment.

Redemption options: Understand the different ways to redeem your points or miles. Some cards allow for flexible redemption options that maximize value, such as transferring points to airline partners. For example, the Chase Ultimate Rewards program enables point transfers to numerous frequent flyer programs, often resulting in higher value for your points compared to cash back.

Payment on travel expenses: Consider using your card to pay for travel-related expenses, such as hotels, car rentals, and airline tickets. This not only helps accumulate points but also safeguards your purchases. Many travel cards come with protections such as trip cancellation insurance, giving added security to your travel investments.

Regular usage: Regularly use your travel credit card for everyday purchases to accumulate points. Pay off the balance each month to avoid interest charges. Data from the Federal Reserve indicates that credit cards used responsibly contribute to more substantial travel rewards over time.

By implementing these strategies, you can effectively maximize the rewards gained from your travel credit card.

What Types of Travel Rewards Can You Earn?

The types of travel rewards you can earn include points, miles, cash back, and travel perks.

- Points

- Miles

- Cash Back

- Travel Perks

The following section elaborates on each type of travel reward.

-

Points:

Points are a form of currency that reward program members earn based on spending. Many hotels and credit cards offer points for purchases. For example, the Marriott Bonvoy program allows members to earn points for hotel stays and spending on certain credit cards. A report by the Travel and Tourism Research Association in 2021 stated that consumers prefer programs offering points as they can be easily redeemed for hotel stays, merchandise, or other travel expenses. -

Miles:

Miles are primarily earned through flight activities and can be redeemed for airline tickets or upgrades. Airline loyalty programs reward customers based on the distance flown or spending on flights. For instance, Delta Skymiles allows members to accumulate miles with every flight booked. According to a 2022 study by the International Air Transport Association, frequent flyers tend to be more loyal to airlines when they can earn and use miles effectively. -

Cash Back:

Cash back rewards give a percentage of purchases back to the user. This type of reward is often offered by travel credit cards like the Chase Sapphire card. Users earn cash back on travel, dining, and other purchases, which can be used toward future travel expenses. Research from CardRatings in 2021 indicated that cash back appeals to users who prefer flexible redemption options. -

Travel Perks:

Travel perks include benefits such as priority boarding, complimentary lounge access, and free checked baggage. These rewards enhance the travel experience and can improve customer loyalty. For example, the American Express Platinum Card offers premium travel perks that make it attractive for frequent travelers. In a 2022 survey by J.D. Power, 70% of frequent flyers cited travel perks as a key reason for choosing specific credit cards or loyalty programs.

How Do Sign-Up Bonuses Impact Your Rewards?

Sign-up bonuses significantly enhance the value of credit card rewards, providing immediate benefits that can boost your overall earnings.

These bonuses commonly impact rewards in various ways:

-

Immediate value: Sign-up bonuses typically offer a large number of points or cash back after meeting a spending requirement. For example, a bonus of 50,000 points can translate to a value of $500 or more in travel or merchandise.

-

Increased earning potential: By receiving a sign-up bonus, a cardholder can quickly accumulate points that contribute to a higher rewards balance. This allows for faster redemption opportunities, providing a sense of immediate gratification.

-

Enhanced loyalty: Attractive sign-up bonuses can encourage users to remain loyal to a specific credit card issuer. A report by the 2022 Consumer Financial Protection Bureau showed that loyalty programs with appealing bonuses retained 30% more customers than those without.

-

Strategic spending: To earn a sign-up bonus, consumers often adjust their spending habits to meet the designated threshold. This habit can lead to increased purchases, thus maximizing the rewards earned not just from the bonus but also from everyday spending.

-

Incentive for higher-tier cards: New cardholders might be encouraged to apply for premium cards with higher fees due to the substantial sign-up bonuses. For example, premium cards such as the Chase Sapphire Preferred offer bonuses that outweigh their annual fees, making them attractive financial products.

-

Travel opportunities: Many sign-up bonuses are structured to be redeemed for travel-related expenses, such as flights and hotel stays. This increases the overall value for frequent travelers and allows them to experience more premium services without additional out-of-pocket costs.

In summary, sign-up bonuses effectively augment credit card rewards, transforming the way consumers view their spending and engagement with credit products.

What Travel Perks Should You Look for When Choosing a Card?

When choosing a travel credit card, look for perks that enhance your travel experience and save you money.

- Reward Points or Miles

- Sign-Up Bonus

- Travel Insurance

- No Foreign Transaction Fees

- Airport Lounge Access

- Higher Earning Rates on Travel Purchases

- Flexible Redemption Options

- Travel Assistance Services

These perks provide varying benefits and can affect your overall travel experience significantly.

-

Reward Points or Miles: Reward points or miles allow you to earn free flights, hotel stays, or discounts on future travel. Many travel cards offer competitive rates, such as two points for every dollar spent on travel-related expenses. For example, a card from Chase allows you to accumulate points that can be transferred to airline frequent flyer programs.

-

Sign-Up Bonus: A sign-up bonus gives you a substantial amount of points or miles after meeting a specified spending threshold within the first few months of opening your account. This can significantly accelerate your ability to redeem rewards and usually ranges from 30,000 to 100,000 points.

-

Travel Insurance: Travel insurance covers unexpected events while traveling. It typically includes trip cancellation, lost luggage, and emergency medical coverage. According to a 2021 survey by the U.S. Travel Insurance Association, 58% of travelers indicated that having travel insurance made them feel secure.

-

No Foreign Transaction Fees: No foreign transaction fees save you money on purchases made outside your home country. Many standard travel cards charge around 3% on these fees, which can add up.

-

Airport Lounge Access: Airport lounge access offers travelers a comfortable space to relax before a flight. Programs like Priority Pass provide entry to various lounges worldwide, enhancing your travel experience by offering amenities such as food, drinks, and free Wi-Fi.

-

Higher Earning Rates on Travel Purchases: Higher earning rates on travel purchases incentivize cardholders to use their cards for travel-related expenses. Some cards offer up to 3x points on hotel stays and airfare, allowing you to maximize rewards on the expenses you incur while traveling.

-

Flexible Redemption Options: Flexible redemption options allow you to use your points or miles for various travel-related expenses. This could include flight purchases, hotel bookings, or even car rentals. Flexibility can often translate into a higher overall value for your rewards.

-

Travel Assistance Services: Travel assistance services provide support in emergencies while traveling. This can include concierge service, emergency cash assistance, or lost passport support. Having these services can significantly ease travel stress during unforeseen circumstances.

What Fees Are Associated with Travel Credit Cards?

Travel credit cards often come with various fees that can impact their overall value and appeal.

- Annual fees

- Foreign transaction fees

- Cash advance fees

- Late payment fees

- Balance transfer fees

- Reward redemption fees

- Authorized user fees

- Card replacement fees

Understanding these fees is crucial as they can significantly affect the benefits received from the card.

Annual Fees:

Annual fees refer to the yearly cost of maintaining a travel credit card. Many premium travel cards charge an annual fee that can range from $90 to over $500. These fees may be justified by extra features, such as travel insurance or access to airport lounges. For example, the Chase Sapphire Reserve card has an annual fee of $550 but offers substantial rewards and benefits that many find valuable.

Foreign Transaction Fees:

Foreign transaction fees apply when you make purchases in a currency other than your own. These fees typically range from 1% to 3% of the transaction amount. They can add up quickly when traveling abroad. For instance, if you spend $1,000 while traveling in Europe, a 3% fee would cost you $30. Many travel credit cards waive these fees, making them a better choice for international travelers.

Cash Advance Fees:

Cash advance fees occur when cardholders withdraw cash using their credit card. Usually, these fees are a percentage of the amount withdrawn, often around 3% to 5%. Additionally, interest on cash advances typically starts accumulating immediately without a grace period, making it an expensive option for obtaining cash. Cardholders should be aware of this when planning to withdraw cash while traveling.

Late Payment Fees:

Late payment fees are charged when a cardholder fails to make at least the minimum payment by the due date. These fees can range from $25 to $40. Late payments can also affect credit scores negatively. Consistently paying on time is crucial to avoid these charges and maintain a good credit rating.

Balance Transfer Fees:

Balance transfer fees are charged when you move a balance from another card to your travel credit card. These fees typically range from 3% to 5% of the amount transferred. While this feature can help consolidate debt, understanding the fees associated is vital to determining if it is financially beneficial.

Reward Redemption Fees:

Some travel credit cards may charge fees for redeeming rewards points or travel credits. These fees vary depending on the card issuer and could diminish the perceived value of the rewards accrued over time. For example, certain cards may charge a fee to book travel using points, which can deter cardholders from maximizing rewards.

Authorized User Fees:

Authorized user fees apply when a primary cardholder adds additional users to their account. These fees can vary widely, from $0 to $50 per user annually, depending on the card issuer’s policies. Some cardholders may find value in sharing benefits with trusted family members or partners, while others may view the additional charge as unnecessary.

Card Replacement Fees:

Card replacement fees are charged if a travel credit card is lost or stolen and needs to be replaced. These fees typically range from $5 to $50, depending on the issuer. Knowing this fee in advance can help cardholders take additional precautions to safeguard their cards while traveling.

How Do Foreign Transaction Fees Influence Your Choice?

Foreign transaction fees can significantly influence your choice of credit card or payment method when traveling abroad. These fees are typically charged by credit card issuers when you make purchases in a foreign currency or through foreign banks.

-

Increased costs: Foreign transaction fees generally range from 1% to 3% of each transaction amount. According to a study by ValuePenguin (2021), an average traveler could incur up to $200 in fees annually if using a card that charges these fees on all foreign purchases.

-

Budget considerations: Travelers need to factor in these additional fees when budgeting for international trips. For example, if a traveler spends $5,000 abroad, a 3% fee could add $150 to the total cost, impacting overall travel spending plans.

-

Card selection: Many travelers now opt for credit cards without foreign transaction fees. A survey by CreditCards.com (2022) revealed that 39% of cardholders considered fee structures as the most important factor when choosing a travel credit card.

-

Currency conversion rates: Fees often accompany foreign transaction costs. Currency conversion rates can vary among card issuers, which can affect the exchange rate applied to your purchase. The U.S. Consumer Financial Protection Bureau (2020) noted that credit card companies might apply their own markup on the official exchange rate.

-

Consumer protection: Some cards without foreign transaction fees also offer better consumer protections such as travel insurance or fraud coverage. Having a card that provides additional security can be critical while traveling in unfamiliar areas.

-

Impact on rewards: Choosing the right card at the right moment can enhance travel rewards. Many travel rewards cards waive foreign transaction fees, allowing travelers to earn points or miles without incurring excess charges. A report by The Points Guy (2023) highlighted that using a rewards card can lead to substantial benefits over time.

These factors form essential considerations that can help guide travelers in selecting the most cost-effective and beneficial payment method for their international spending.

How Can You Compare Different Travel Credit Cards for Savings?

To compare different travel credit cards for savings, consider the following key features:

| Credit Card | Annual Fee | Rewards Rate | Sign-Up Bonus | Foreign Transaction Fee | Additional Benefits |

|---|---|---|---|---|---|

| Card A | $95 | 2x points on travel | 50,000 points after spending $3,000 in the first 3 months | None | Travel insurance, no foreign transaction fees |

| Card B | $0 | 1.5x points on all purchases | 20,000 points after spending $1,000 in the first 3 months | None | Cashback on all purchases |

| Card C | $450 | 3x points on travel and dining | 100,000 points after spending $4,000 in the first 3 months | 3% | Priority boarding, airport lounge access |

| Card D | $99 | 2x points on travel and dining | 30,000 points after spending $2,000 in the first 3 months | None | Travel insurance, no foreign transaction fees |

When comparing travel credit cards, evaluate the rewards rates, annual fees, and any sign-up bonuses to determine which card offers the best savings based on your travel habits.

What Should You Look for in Terms of Interest Rates and Fees?

When evaluating interest rates and fees, focus on the costs associated with borrowing or credit products. Key factors include both the interest rates and various fees that can affect overall expenses.

- Interest Rates

- Annual Percentage Rate (APR)

- Origination Fees

- Closing Costs

- Prepayment Penalties

- Late Payment Fees

- Foreign Transaction Fees

The interplay of these factors can significantly influence the total cost of borrowing and should be considered carefully.

-

Interest Rates: Interest rates represent the cost of borrowing money, expressed as a percentage. They can be fixed or variable. Fixed rates remain constant over time, while variable rates can fluctuate based on market conditions. According to the Federal Reserve, consumer loan rates had an average of 5.2% in 2023, making this a critical factor for borrowers.

-

Annual Percentage Rate (APR): The APR reflects the total cost of borrowing on a yearly basis, including interest and fees. It provides a more comprehensive measure than the interest rate alone. For example, a loan with a low interest rate but high fees might have a higher APR than a loan with a somewhat higher rate but lower fees. Borrowers should compare APRs across different products to determine the true cost.

-

Origination Fees: Origination fees are charges by lenders for processing a new loan. They typically range from 0.5% to 1% of the loan amount. Understanding these fees is vital because they can add significant costs to the total loan amount. For instance, on a $100,000 mortgage, a 1% origination fee would cost $1,000.

-

Closing Costs: Closing costs encompass various fees associated with finalizing a loan. They can include appraisal fees, title insurance, and attorney fees. According to the Consumer Financial Protection Bureau, closing costs typically range from 2% to 5% of the loan amount. Borrowers should request a detailed breakdown of these costs early in the loan process.

-

Prepayment Penalties: Prepayment penalties are fees charged if the borrower pays off the loan early. These penalties can deter individuals from refinancing or selling their homes. Not all loans carry this fee, and understanding whether it applies is crucial for long-term financial planning.

-

Late Payment Fees: Late payment fees apply if a borrower fails to make payments by the due date. They can typically range from $25 to $50. Such fees can add to the overall burden of debt, further complicating financial planning.

-

Foreign Transaction Fees: These fees are relevant for credit cards and can apply when purchases are made in a foreign currency or through foreign banks. They usually amount to 1% to 3% of the transaction. Understanding these fees is important for travelers who wish to avoid extra charges while abroad.

Being informed about these elements ensures borrowers make better financial decisions regarding loans and credit products.

What Factors Should You Consider When Selecting the Best Travel Credit Card?

When selecting the best travel credit card, consider rewards, fees, flexibility, and travel perks.

- Rewards structure

- Annual fees

- Sign-up bonuses

- Foreign transaction fees

- Redemption options

- Travel insurance benefits

- Partner airlines and hotels

- Introductory rates

- Customer service

Selecting the right travel credit card involves evaluating various factors that can significantly impact your travel experience and savings.

-

Rewards Structure:

The rewards structure refers to how points or miles are earned for every dollar spent using the card. A card may offer higher points for specific categories such as flights, hotels, or dining. For example, a card might offer 3 points per dollar for travel-related purchases and 1 point for all other expenses. This structure incentivizes cardholders to use their cards for travel expenses to maximize rewards. -

Annual Fees:

Annual fees are the yearly charges you pay for having the card. Some travel cards come with no annual fee, while others could have fees exceeding $500. It is important to assess whether the rewards and benefits of the card justify the cost of the annual fee. For example, a card with a high fee might offer extensive travel perks that outweigh the costs if you travel frequently. -

Sign-Up Bonuses:

Sign-up bonuses are rewards offered to new cardholders after they meet a spending requirement within a specified period. These bonuses can significantly boost your points or miles balance. For instance, some cards might offer 50,000 bonus points after spending $3,000 in the first three months. This can be an excellent way to kickstart your travel rewards collection. -

Foreign Transaction Fees:

Foreign transaction fees are charges incurred when making purchases outside your home country. Some credit cards waive these fees, making them ideal for international travelers. A typical foreign transaction fee can range from 1% to 3%. Choosing a card with no foreign transaction fees can lead to substantial savings on international trips. -

Redemption Options:

Redemption options define how and when you can use your earned points or miles. Some cards allow flexibility to redeem points for flights, hotel stays, or even cashback, while others may have restrictions. It’s essential to check whether points can be used easily or if they expire, as this affects their overall value. -

Travel Insurance Benefits:

Travel insurance benefits may include coverage for trip cancellations, lost luggage, or travel delays, providing added security for travelers. Some credit cards offer these benefits at no extra cost, whereas others charge for them. This feature can be particularly beneficial for frequent travelers, as it can alleviate the financial risk associated with unforeseen circumstances. -

Partner Airlines and Hotels:

Many travel credit cards have partnerships with specific airlines and hotel chains. These affiliations can boost your rewards when booking through partner establishments. Understanding the program within which you will frequently travel can maximize the benefits of the card. -

Introductory Rates:

Introductory rates often include reduced interest rates on purchases or balance transfers for an initial period. This feature can be useful if you plan to carry a balance temporarily. Lower introductory rates can assist in managing costs if planned accordingly but should be compared against the long-term rates after the introductory period ends. -

Customer Service:

Customer service quality is crucial when dealing with travel-related issues such as lost cards or disputed charges. Researching customer service reviews and ratings can provide insights into how efficiently a credit card issuer manages issues. A good customer service experience can enhance your travel experience significantly.